It's about letting you focus on making projects more successful.

Spend less time worrying about paperwork and more time focusing on your customers.

Mobile Time Tracking

Workers in the field can clock-in on their own GPS-enabled devices and the supervisor or client can approve time in the field or home office.

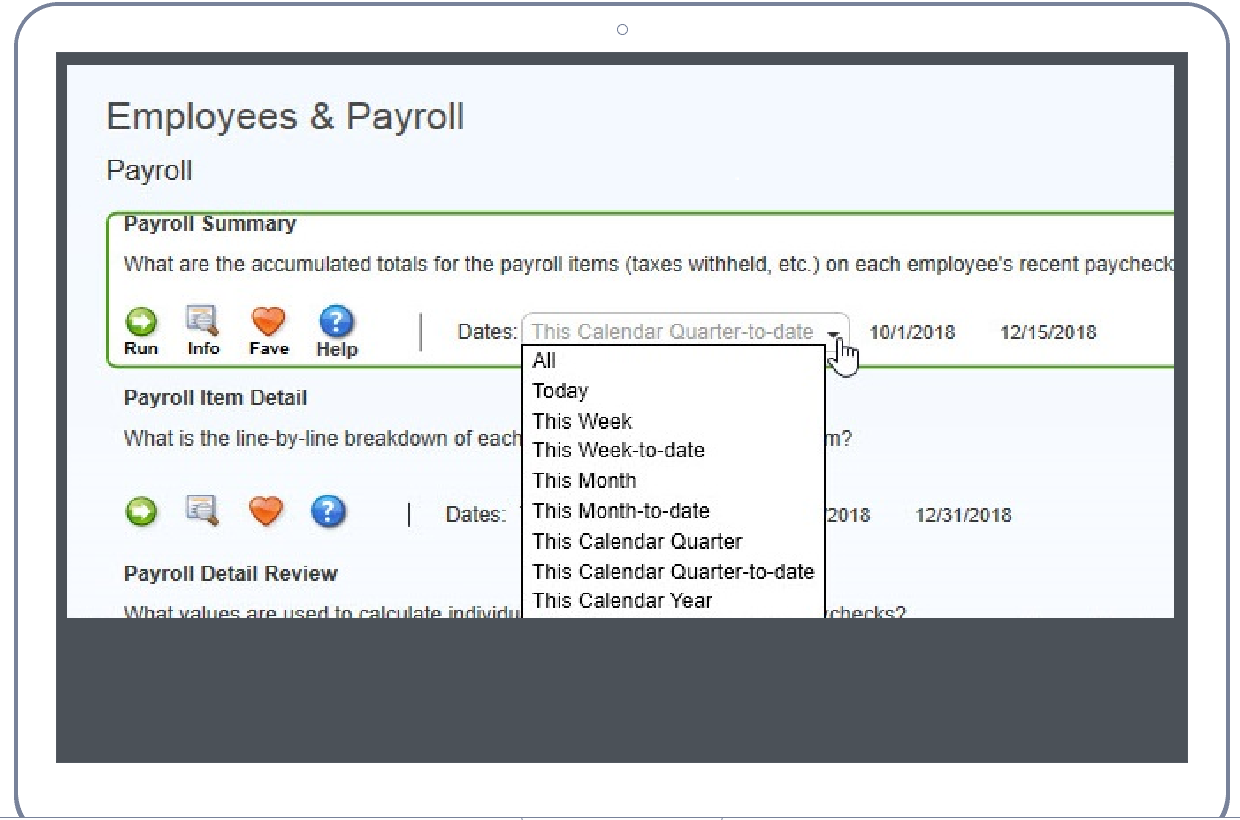

Simple Reports

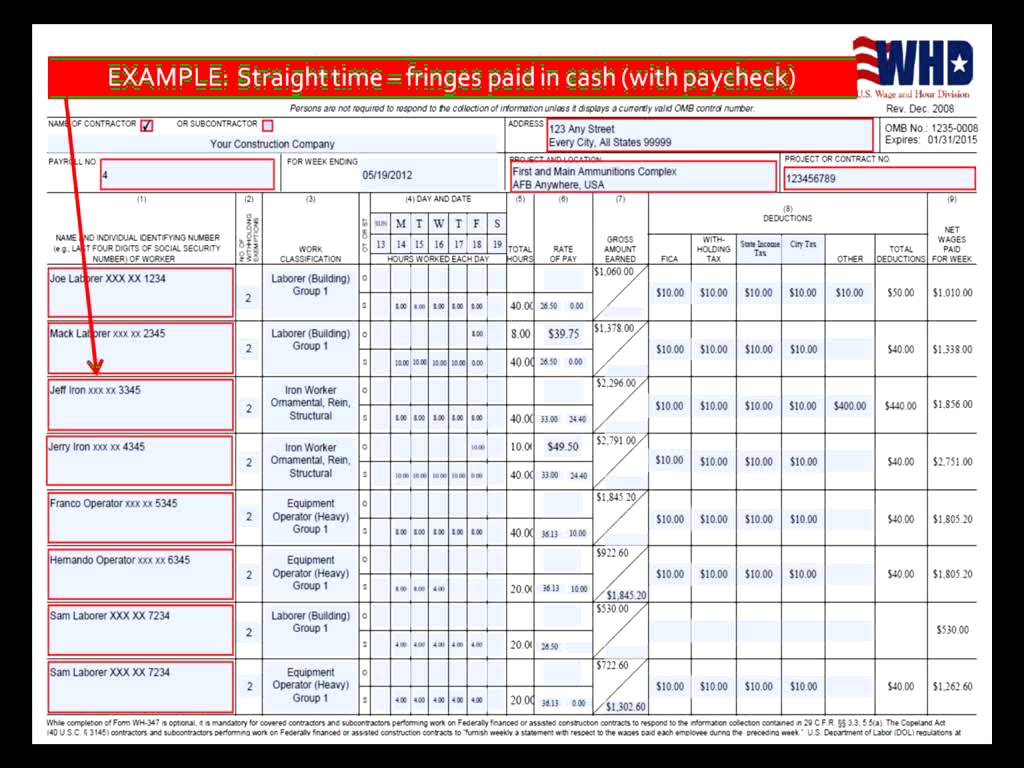

Real-time information on dashboard shows hours worked, Certified Payroll, payroll approval, and gives a snapshot of overall project's performance.

Reliable Compliance

All local, state, and federal reporting is covered automatically. Employees get paid on time and have real-time access to all of their payroll information.

Explore Features

Site-Pay is more than traditional payroll, it's built for site project work!

Easily pay your workers

With Site-Pay, you'll get an easier way to pay your off-site workers in any location.

Site-Pay gets your employees paid efficiently.

All of the features and tools needed for off-site project work in one place.

Reports for You and Clients

With Site-Pay, all needed information is in one place:

Required steps in payroll administration.

Things that are handled for you when using Site-Pay.

Site-Pay can process payments using your accounts.

Site-Pay can disburse employee wages and employment taxes for you using all of your existing account and tax ID numbers. With this approach, your company remains the employer of record. However, Site-Pay will generate employee tax documentation and summary fianancial information for your company, ensuring that all required documentation is provided to employees and your company on a timely basis.

Site-Pay can fund employee wages and taxes directly using our own tax ID numbers and workers' comp insurance.

In this case, Site-Pay handles all of the expenses directly and debits your account for the net employee expense. This simplifies your accounting and end-of-year tax preparation, and it eliminates the need to have workers' comp accounts in multiple states.

Sign-up for Site-Pay Tools today!

Upgrade, downgrade, or cancel your plan anytime.

Why wait? Start now!

Get Started Today

Choose the plan that suits you best or start by getting a quote on Site-Pay Tools.

Site-Pay Tools

- Automated time keeping

- Worker on-boarding tools

- Reports of hours worked and paychecks due

- Employee summary reports

- Summary reports for tax and other disbursements

Site-Pay Processing

- Automated time keeping

- Worker on-boarding tools

- All payroll functions

- Disbursement of all taxes, worker's comp, and unemployment insurance

- Filing W-2 and 1099-MISC forms

- Certified Payroll reports

Looking for more? — If you have a specific request, we'd like to hear about it! Contact us

What companies are saying

Find out why companies are interested in Site-Pay

Site-Pay can make our work hours more accurate and timely. It will allow us to properly account for all billable hours to our clients and prevent cost over-runs from unbillable hours.

Sharon WesterfieldProject Manager @ Hargrove Engineers

The Site-Pay tools make keeping up with our work crews in the field much simpler. Using their services will greatly reduce the time I spend to get my people paid.

Murad HassanBusiness Development Manager @ Arc Energy

Getting time recorded and payments made for the project team without spreadsheets and phone calls will save a large amount of time for us - it's an easier process.

Jeremy GrayProject Engineer @ Jacobs Engineering